Hey Future Owner

Supply Run with the Kids

No new booking inquiries today—one of those slower days. So, I shifted gears and tackled some errands. The kids were along for the ride while I hunted down the right nuts, bolts, and a gas stake driver for our outdoor flooring setup.

After hitting multiple Home Depots, I finally found what I needed. The gas post driver options? Overwhelming. Honestly, I’m just going to rent this round until I know what works best. Deep down, what I really want is to skip the hassle and buy a Tent OX.

Content Push: Blog Posts Live

In between errands and parenting, I squeezed in two new blog posts. Both targeted traffic magnets:

Woodgrain Chairs

White Drum Fans (the ones I had to buy for that June event)

Small but strategic moves to keep driving eyes to the inventory.

A Year of Data… and Insights

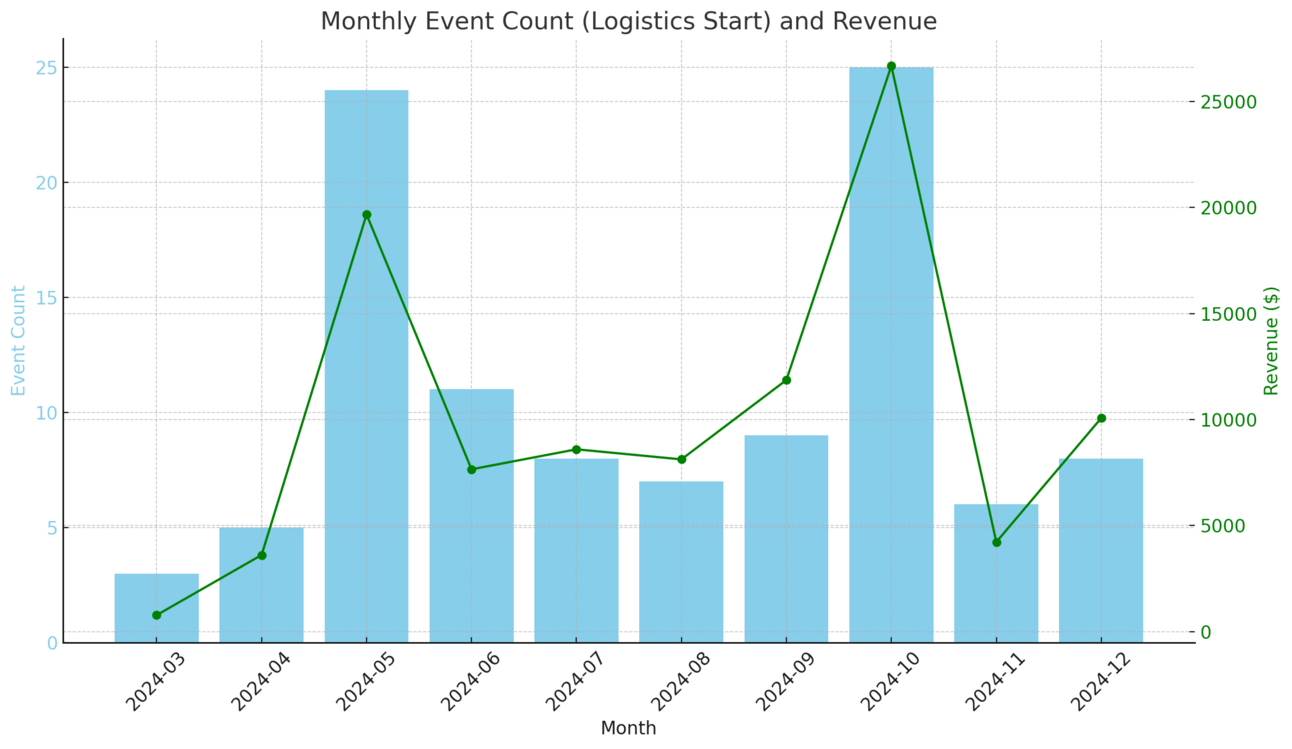

Probably the most important part of the day—I realized I’m sitting on nearly a full year of business data. So, naturally, I put ChatGPT to work.

The result? Graphs, plots, and actual insights that made the grind feel worth it. There’s real value in seeing the patterns laid out. It’s already shaping how I think about the next season.

✅ 1. Event Volume Drives Revenue but Not Linearly

May shows a huge spike in Event Count and Revenue, confirming busy season.

June and July maintain decent counts, but Revenue dips, hinting that:

Jobs in those months might be smaller or lower-ticket.

Your team is busy but potentially less profitable per job.

💡 Insight:

Volume ≠ Revenue — focus on booking higher-dollar projects in slower months.

Consider pricing adjustments or pushing upgrades (lighting, flooring, etc.) in June-July.

✅ 2. Quote Total vs. Revenue Exposes Conversion or Collection Gaps

If your Quote Total line is significantly above Revenue in any month:

You’re either losing booked business or

Failing to convert quotes into revenue or

Not collecting full payment (cancellations, reductions, etc.)

💡 Insight:

Review sales follow-up process or cancellation reasons in those months.

Tighten terms & conditions to protect revenue.

✅ 3. September-October Opportunity

Historically busy months in the industry (Fall weddings, festivals).

Your data: Shows strong revenue but event count plateaus — potential to add volume here.

💡 Insight:

Target marketing to corporate clients or festivals in Q3.

Build early booking campaigns to fill those months.

✅ 4. Revenue “Per Event” Variance

Example: May — 24 events / $19K+ revenue → ~$820 per event.

June/July — Lower revenue per event.

💡 Insight:

Know your sweet spot: If “high-volume low-ticket” months are labor-heavy, is it worth it?

Track cost per event and gross margin monthly.

✅ 5. Future Growth Planning

Flat event count in some months (Aug-Dec) but revenue climbs → Large jobs?

Quote spikes in October might indicate big potential — if unconverted, why?

💡 Insight:

Consider adding resources or specialized teams for peak seasons.

Use Quote vs Revenue trends to guide hiring, inventory purchases, and cash flow planning.

Closing Thoughts

Slow days like this might not feel productive, but they build the foundation. Between tightening up the inventory, creating content, and digging into data, the business keeps moving forward—even without new bookings.

Talk soon—one step closer, always.